At the end of December 2017, the House and Senate voted to pass the most significant changes to the tax law since 1986. President Donald Trump signed the tax bill just a few days before the Christmas holiday. The changes become effective for the 2018 tax year forward with some changes being rolled out incrementally. While there are numerous changes for corporations - some companies have already paid out bonuses to employees - consumers are also impacted by the new law. Here are two of the most impactful changes for consumers.

#####New tax brackets will lead to bigger paychecks, in the short term

Most workers know a portion of their income goes toward (among other things) Federal taxes. To keep things simple, the government sets tax brackets and a range of incomes that are taxed at that rate. For example, in 2017, a single taxpayer making between $9,326 and $37,950 fell in the 15% tax bracket. (To complicate things a little more, income is actually taxed at levels. Income up to $9,325 is taxed at the lower 10% rate and income above $9,326 would be taxed at 15% rate.)

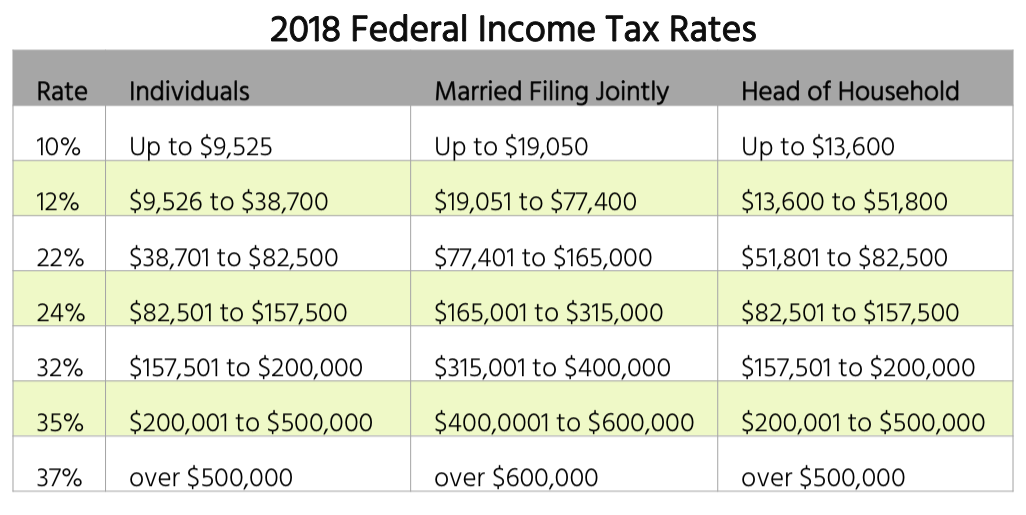

The new tax law keeps the seven tax bracket structure that’s been in place since the 2013 tax year, but the rates and income levels have been adjusted. The result is a lower tax rate for the majority of wage earners. The new tax brackets are: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Most middle class families will fall in the 12 percent tax bracket.

Thanks to the change in tax brackets, an estimated 90% of workers will see a change in the amount of Federal tax withheld in each paycheck, according to the U.S. Treasury. The decreased withholding means a slightly bigger paycheck. If you haven’t already, you’ll see the change in your paycheck no later than February 15th.

Before you get too excited about the increased spending power, make sure your paycheck isn’t increased by too much. Otherwise, you could end up with a tax bill rather than a refund next April.

If there have been any changes to your household, complete a new W-4 form to adjust your exemptions. This will allow your employer to more accurately estimate your withholding.

Note that income levels for each tax bracket will rise each year with inflation, based on the chained consumer price index. The result is that, over time, many Americans will be pushed into higher tax brackets. Individual changes resulting from the new tax bill will expire at the end of 2025. At that time, the tax rates and the standard deduction revert back to their 2017 levels.

#####A bigger standard deduction may eliminate itemized deductions for many people.

The new tax bill increases the standard deduction which gives taxpayers less incentive to itemize deductions. The standard deduction is an amount you’re allowed to deduct from your taxable income and reduce your overall tax liability.

In 2017, a single taxpayer could take a $6,350 standard deduction and a personal exemption of $4,050. Under the new tax law, there is no more personal exemption and the standard deduction for single filers in increased to $12,000. Joint filers can take a standard deduction of $24,000.

Many people who previously itemized deductions - i.e. listed out all their deductible expenses - may find it more beneficial to take the standard deduction. Not only because of the increase in the standard deduction, but also because many previously allowed deductions have been eliminated. For example, you can no longer take a deduction for moving expenses (except for military), alimony paid, and casualty and theft losses except those due to a federal disaster as declared by the President.

Not all the itemized deductions are going away and you can still itemize your deductions if the total amount of these deductions is greater than the standard deduction. For instance, you can deduct medical expenses that add up to more than 7.5% of your adjusted gross income and mortgage on up to $750,000 ($375,000 for single tax filers) on a qualified mortgage.

You can still deduct up to $2,500 in student loan interest each year as an above the line deduction (a deduction you can take even if you take the standard deduction).

Note that this is not an exhaustive list of changes, none of which will affect your 2017 tax returns. It may be helpful to consult a tax professional to learn more about how the new tax law will affect you personally.