Updated January 9, 2020

While there are benefits to accepting ACH for payments, like lower processing costs and ability to set up recurring transactions, the settlement process is notoriously long compared to debit and credit transactions.

Over the year, the industry has made significant improvements to ACH processing time, with same-day settlements available in some cases. Let’s explore the ACH settlement process to learn why transactions can often take a long time to settle.

Who’s Involved in an ACH Transaction?

One of the reasons that ACH settlements take so long is the number of parties involved in the transaction. Payment processors collect payment data from merchants. The payment data is sent to an originating bank, which submits the ACH data to Federal Reserve for overnight processing. Finally, the Federal Reserve sends the ACH transaction to the customer’s bank.

ACH transactions involve several different parties each adding to the time it takes to complete a transaction. First, payment processors collect payment data from merchants. The payment data is sent to the originating bank, which submits the ACH data to Federal Reserve usually for overnight processing. Finally, the Federal Reserve sends the ACH transaction to the customer’s bank.

ACH Carries a Risk of Reversal

Longer settlement times for ACH transactions can be used as a risk management measure. Credit and debit card transactions, by comparison, are authorized and approved immediately. Unless the consumer later notifies the bank or the merchant that the transaction was fraudulent, the transaction will typically go through. However, ACH transactions aren’t authorized right away and can be rejected or reversed after they’re submitted to the receiving bank (the customer’s bank).

The originating bank and merchant never receive a “confirmation” that an ACH transaction has been successfully processed. There’s only communication when the transaction is rejected. In some cases, the originator may wait a few days to be sure the transaction isn’t reversed before depositing funds into the merchant’s bank account.

Processing Times for ACH

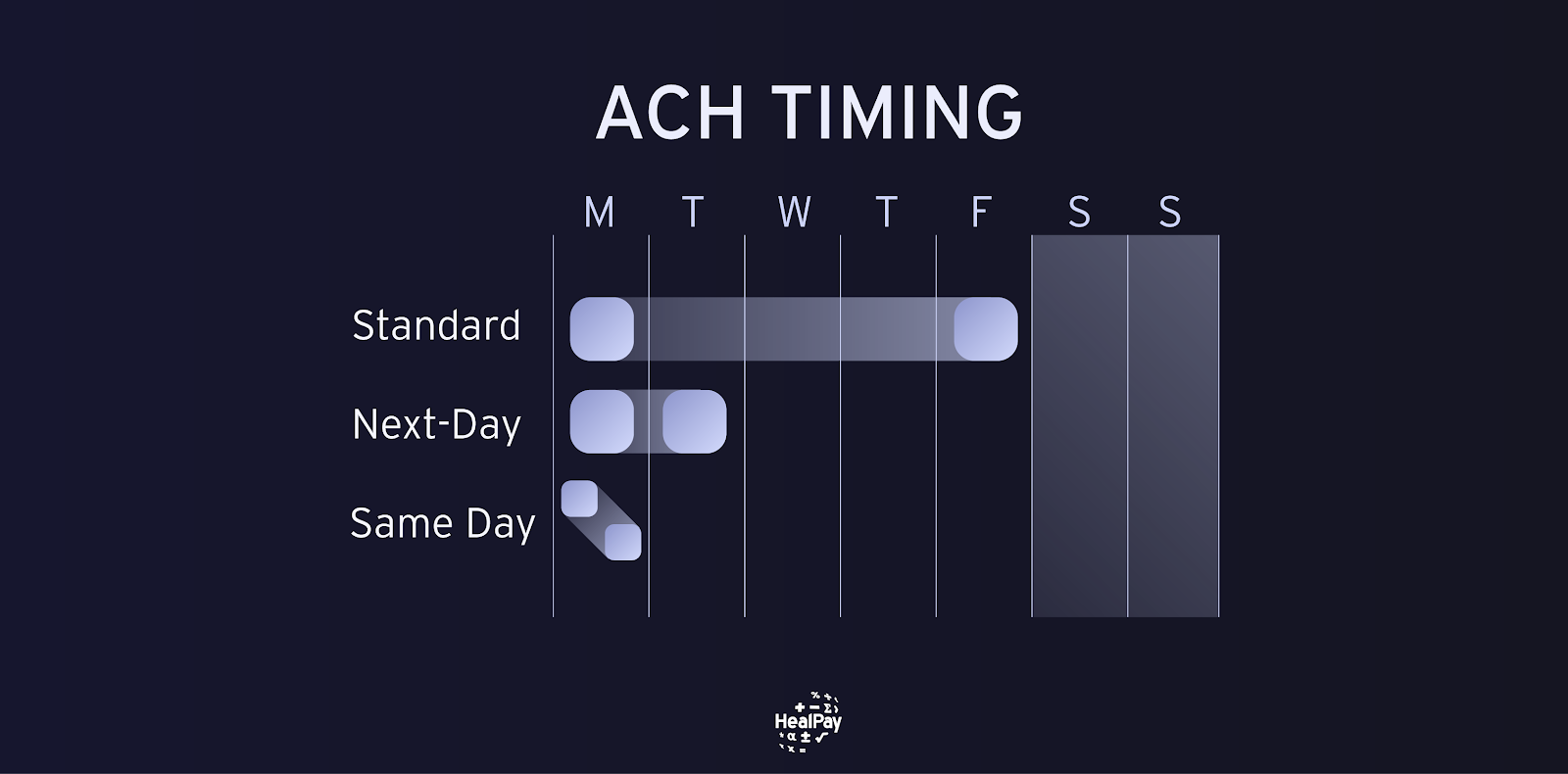

ACH transactions aren’t processed real-time. Instead, these transactions are processed in batches and each batch must be sent by a certain time of day to be processed overnight. Any requests made after the cutoff time won’t be processed until the next business day, which means that transactions processed after the cutoff time on Friday won’t be processed until the following Monday.

With ACH transactions, banks can’t simply transfer funds to each other. ACH transactions have to clear the Federal Reserve before they’re sent to the customer’s bank. Traditionally, this process occurred once daily overnight, which meant that ACH transactions would take at least one business day to settle.

Reversals can delay settlement, particularly if there was an error in the data submitted. If a transaction is reserved, the receiving bank notifies the Federal Reserve that the payment was returned. The Federal Reserve doesn’t notify the originating bank. Instead, the originating bank checks with the Federal Reserve daily to see if there are any returned transactions for them.

Some third-party ACH transactions take longer because the payment processor will debit the customer’s account first, wait until that transaction has cleared and then will credit the recipient’s account.

Same-Day ACH Settlements

The National ACH Association (NACHA) has made strides toward a same-day settlement process that allows ACH transactions to settle much faster than the 3 to 5 days it currently takes.

Under the new NACHA rules, originating financial institutions can submit same-day ACH transactions for settlement at 10:30 AM ET and 2:45 ET, with settlement occurring at 1:00 PM and 5:00 PM. By 2021, a third settlement window will be added allowing same-day ACH transactions to be submitted until 4:45 PM ET.

Businesses are quickly adopting same-day ACH payments. In the third quarter of 2019, NACHA processed 66.6 million same-day ACH payments, a 54% increase over the same period in 2018.

While the ACH settlement time can be frustrating at times, it’s still preferable to processing paper checks. HealPay’s payment suite offers a variety of ACH timing options including standard, next-day, and same-day ACH payments. Contact us to learn more.